Why is Tracking Changing Regulations So (Increasingly) Important?

58% of companies call tracking changing regulations a high priority for 2022, according to data gathered in our recent survey, The Top Challenges of Monitoring Regulatory Risk in 2022. The survey includes data from interviews with 120 business leaders working at companies developing software in GRC, RegTech, Regulatory Risk Management, and Regulatory Intelligence.

Why is this task so important, and how can today’s regulatory tracking vendors help businesses with their ongoing strategy?

Why is regulatory tracking so essential?

Today, compliance regulations have become part and parcel of almost all industries, from SOX for financial reporting, to PCI-DSS for eCommerce, KYC in Banking, Insurance, or Finance, or ISO 9000 in the Manufacturing and Service industries.

Failure to achieve and remain compliant can cause huge headaches for business leaders. It can lead to fines and penalties, the inability to continue providing their product or service until compliance is attained, and of course – the constant threat of a cyberattack where the blame will be placed at their door.

The need for technology in tracking changing regulations

In recent years, Risk Management software and RegTechs have become key players in supporting companies to identify, analyze, monitor, mitigate and report external noncompliance risks.

Because compliance means adhering to external requirements such as corporate policies, legislation, and regulations, they have increasingly automated their monitoring of external data sources to enable institutions to comply with regulatory needs, monitor any wrongdoing, develop a holistic approach to data management, and increase overall efficiency.

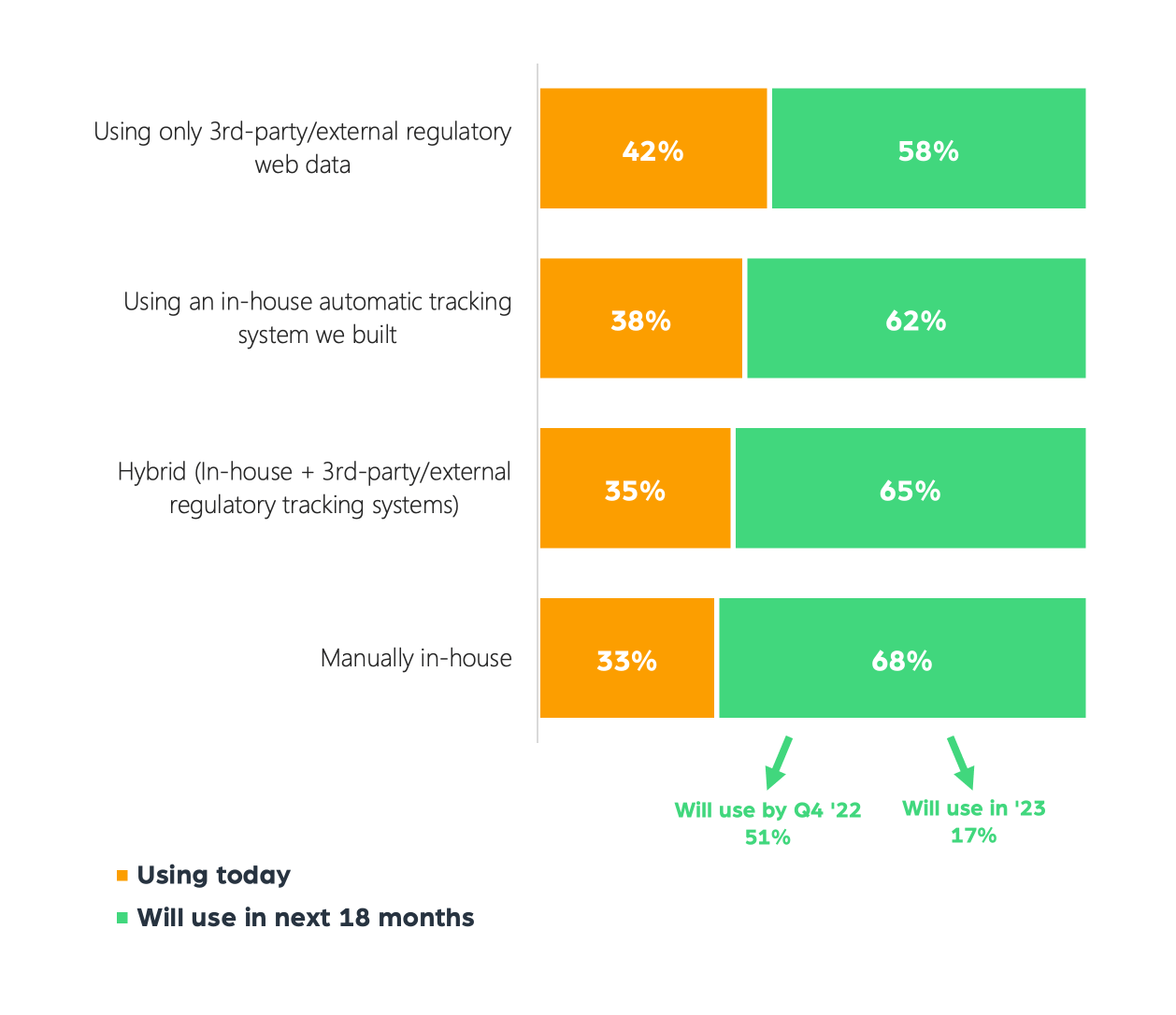

However, despite the widespread use of automation and technology to track regulatory data, (our survey showed just 33% of businesses are performing this task manually), Deloitte reports that 78% of companies are concerned about their ability to adapt to changing regulatory requirements.

As today’s tools aren’t meeting the need – it’s no surprise that the report reveals that 76% of our respondents are looking to switch vendors – and that they are doing it fast, indicating they aren’t interested in waiting around to make that change.

The biggest challenge: Growth in the volume of regulations

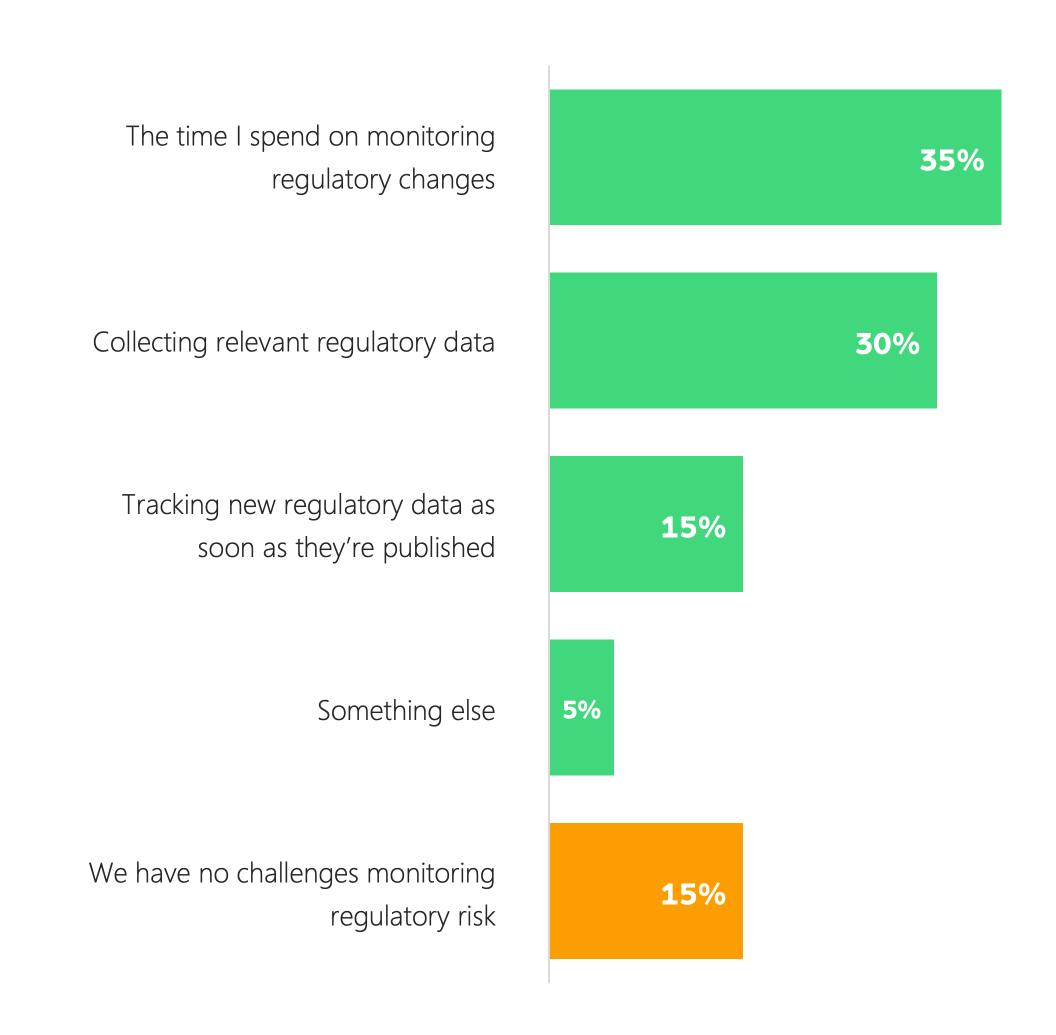

What’s causing dissatisfaction with today’s technology? The greatest challenge for today’s organizations is the amount of time it takes to monitor changes in regulations.

We found that on average, businesses are spending 40 hours each month on monitoring regulatory compliance risks. This is already a huge time investment, and the challenge is growing year on year as the volume of data increases.

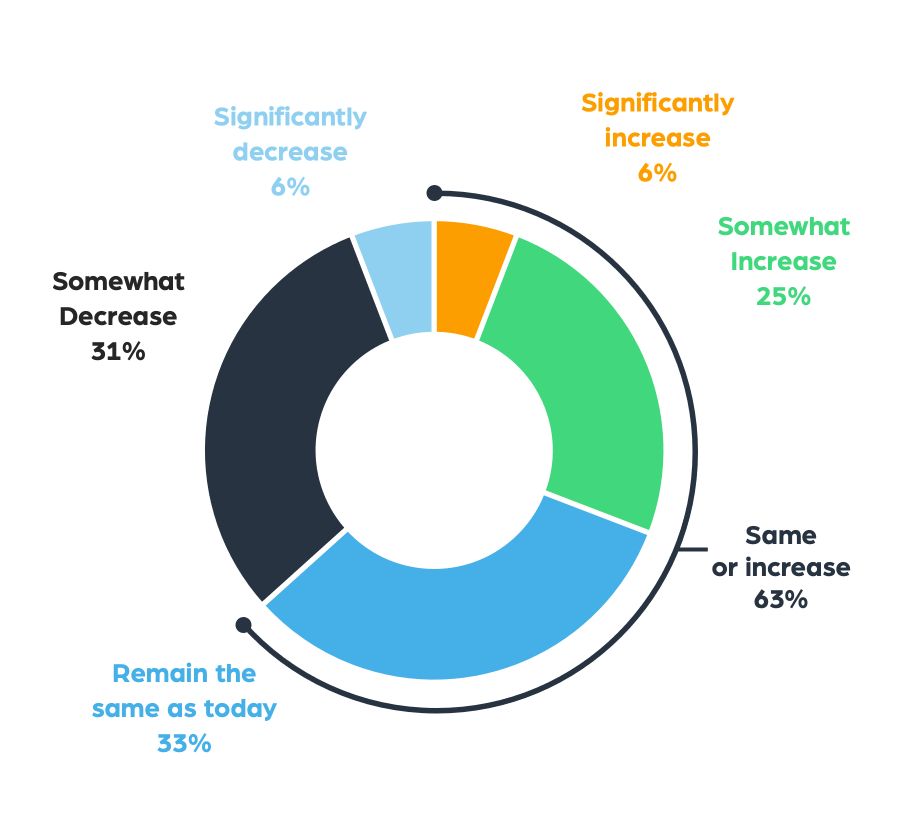

Back in 2021, Thomson Reuters reported that 78% of stakeholders believed the volume of regulatory information they needed to track would increase in the year ahead. Our more recent data shows that this wasn’t a one-off challenge because of the impact of the pandemic or any other global shift.

Only 37% of our respondents believe that the volume of regulatory data they need to track will decrease in the next 12 months, and 73% believe they will need to invest the same or more time on this task next year.

What is involved in regulatory tracking of web data?

It’s clear that today’s automation and regulatory tracking technologies aren’t meeting the need. If companies are deploying effective automation, then they wouldn’t be worried about the growing volume of regulatory data, and they certainly wouldn’t be investing so many people-hours in staying abreast of regulatory changes.

To meet this challenge head-on, businesses need to be able to access the right data that affects their industry, as quickly as possible, and without adding hours of manual effort to their workload.

While each business has its own regulations to keep to, and every use case is different, let’s take a look at two examples of the kind of data that automation needs to monitor and collect for specific compliance mandates.

KYC and Anti-Money Laundering (AML) compliance data

There were more AML fines levied in 2021 than in any year previously. Financial organizations need to stay on top of AML regulations to ensure that they remain compliant and avoid financial penalties, reputational loss, and even destabilizing the financial markets themselves. Data that organizations need to stay on top of includes:

- KYC/KYB watchlists

- PEP (Politically Exposed Person) lists

- Money laundering lists

- Terrorist funding lists

- Sanction lists

- Screening lists

Vendor risk management data

Vendor risk management, also known as third-party risk management (TPRM) is a huge issue for organizations of all kinds today. How well do you know the companies that you’re doing business with? Partners, suppliers, contractors, and other service providers often access your sensitive data or connect to your IT environment, and it’s part of your due diligence to make sure this doesn’t impact your compliance posture. You’ll want web data such as:

- Structures and unstructured data about third-parties

- Government rules and regulations on third-party access

- ESG data

- Sanction lists

- Corporate filings

- Historical data without a cap on the number of years

- Data that travels across jurisdictions

Quickly gaining access to this data is just step one

With so much data to uncover, and a growing volume of regulatory changes to contend with, organizations simply can’t afford to stick around with technology that isn’t meeting their need. After all, uncovering the data is just step one.

The most effective software solution will be able to crawl the web, collect the right data and structure it into a unified data feed, and then also allow you to filter and search by specific attributes for more granular data analysis and speedier action.

You can download the full survey report The Top Challenges of Monitoring Regulatory Risk in 2022, and make sure to reach out to discuss how your business can better automate your regulatory tracking services with the latest, structured regulatory web data.